How bank deposits (normally) work

Under the federal Regulation CC, banks and credit unions are legally required to make your deposited funds available within a specific time frame — but it’s not always a perfect science, as Garland’s experience indicates.

Generally, if you deposit cash or checks for $200 or less in person to a bank employee, you should be able to access the full amount the next business day, according to the Consumer Finance Protection Bureau. If you deposit funds over $200, you should be able to access $200 the next business day, and the rest of the money the second business day. If you deposit your funds through an ATM at your bank, you should be able to withdraw or use that money on the second business day.

Sometimes banks or credit unions may make your money available quicker than the law requires — especially if they’re hyper-focused on customer service — and some may do so for an extra fee. If you’re not sure when to expect your funds, you can ask your bank or credit union for their deposit policy.

Remember, different banks may have different cut-off times for what they consider to be the end of the business day. If you make your deposit after the cut-off time, your bank could treat your deposit as if you made it the next business day.

Read more: Unlocking financial prosperity: Jeff Bezos shares the path to prime earnings through hassle-free real estate investment — don't miss out on this opportunity to revolutionize your financial future

When banks are allowed to delay funds availability

Under certain circumstances, Regulation CC does allow financial institutions to delay the availability of funds for a “reasonable period of time.”

A “reasonable” time period is generally defined as one additional business day (making a total of two business days) for checks, and five additional business days (total of seven) for nonlocal checks — these are checks deposited in a different check processing region than the paying bank.

That delay may occur if:

- You make a deposit over $5,000

- Your account has been overdrawn too many times in the past six months

- You made the deposit at an ATM owned by someone other than your bank or credit union

- Your bank or credit union has cause to doubt the collectability of your check (e.g. if the check is dated more than six months earlier)

- You or your bank redeposit a check that has been returned unpaid.

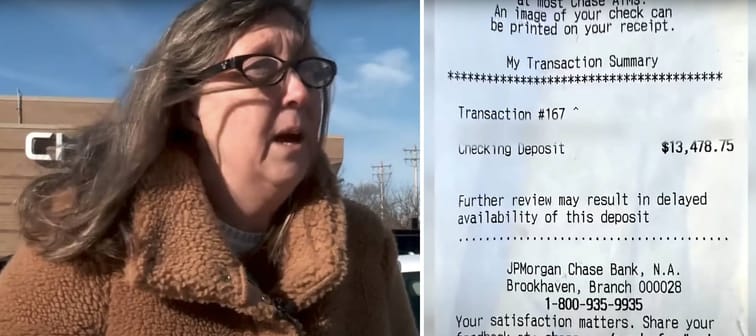

Chase did not confirm the cause of the delay in Garland’s case.

What you can do if a problem arises

Garland’s stressful encounter serves as a reminder to always keep your deposit slips until your money has landed in your account.

If your money is delayed, you should contact your bank and use this deposit receipt as proof of your transaction. If your slip contains an error or the associated amount of cash or checks don’t match, banks have policies and procedures in place to reconcile any discrepancies.

In the circumstance that your bank does not honor your deposit receipt or check evidence, you may need to seek legal assistance to resolve the issue, according to HelpWithMyBank, an official website of the U.S. government.

Sometimes, deposit problems are caused by external factors. Late last year, multiple U.S. banks were hit by deposit delays after an error at a payment processing network.

At the time, Bank of America told its customers: “Your accounts remain secure, and your balance will be updated as soon as the deposit is received. You do not need to take any action.”

In instances such as these, follow the instructions of your bank — but still keep hold of your deposit receipt or check information in case you need to contest any issues with your bank in the future.

What to read next

- Robert Kiyosaki warns 401(k)s and IRAs will be 'toast' after the 'biggest crash in history' — protect yourself now with these shockproof assets

- Jeff Bezos and Oprah Winfrey invest millions in this rare asset to keep their riches safe — How to ride their coattails even if you're not super rich

- Credit card interest rates stand at a staggering 28.9%. Use this free online tool to pay off your debt ASAP — so you can get unstuck and start building real wealth