Elusive profits

Melanie’s husband is a physical education teacher at a local school. Four years ago, he rented a space to offer personal training services as a side hustle. Unfortunately, rent on this unit chews up most of his revenue. She says the business generates anywhere from $1,500 to $2,500 a month, while rent is $1,600. Add to this utility bills, internet services and other miscellaneous expenses, and the business doesn’t make substantial profit, if any.

Around 35% of small businesses were unprofitable, according to a survey by Guidant Financial, and on average it took between two and three years for a business to start making money. Meanwhile, nearly half (48%) of the businesses launched in 2018 did not survive by 2023, according to data from the Bureau of Labor Statistics.

This phenomenon isn’t restricted to microbusinesses. An analysis of Goldman Sachs data by Stephane Renevier, CFA, reveals that nearly 50% of publicly-traded companies had negative profit margins. Well-known brands like Doordash and Boeing have reported fourth-quarter losses. Several megacorporations, including Silicon Valley Bank and Bed Bath & Beyond have also filed for bankruptcy in recent memory.

After four years of trying, Melanie believes it’s time to have an honest conversation with her husband about his business.

“As a business owner, at what point do you say it’s not viable anymore?” she asked.

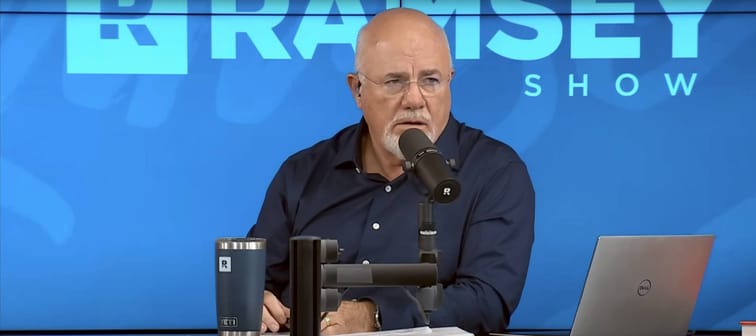

Ramsey had a clear answer: “If there's not a change that'll make it viable then it's time to shut it down.”

Meet Your Retirement Goals Effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedTime for a change

Before throwing in the towel, however, Ramsey encourages Melanie and her husband to explore all options. Instead of renting an expensive unit, the business could be operated from the couple’s basement, or the husband could make house calls. Both options would go a long way toward making the venture cash flow positive.

Melanie’s husband also has the option to seek regular employment at a local gym. A part-time job as a personal trainer could add some income to the household’s monthly budget.

Put simply, there are many options for the couple that seem more viable than the current state of affairs. Ramsey encourages them to create a spreadsheet to track profits and losses over the past twelve months. If the business is as unprofitable as Melanie believes, it’s may be time to end the lease and move on.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.